Biotech’s Silk Road: The Global Future of Clinical Trials

- Jun 30, 2025

- 5 min read

Updated: Jun 30, 2025

The history of medicine is rooted in the intercultural exchange of products and ideas. For millennia, the Silk Road was a vast trading route linking the civilizations of China, India, the Middle East and Europe. Herbs, powders, and medical texts were transported and synthesized across far-flung regions of the known world.

Celebrating Clinical Trials Day in 2025, the past is prologue. This is an era when global integration once again plays a vital role in advancing human health. May 20 is recognized as the day in 1747 of the first randomized control trial. British navy surgeon James Lind ran an experiment feeding citrus fruit to sailors, intending to eliminate scurvy on maritime voyages. In finding a cure, Lind radically expanded the British Empire's capacity for long-distance shipping and communication. In the 21st century, global supply chain and digital communication networks are the foundation for a system of clinical trials to create new drugs and devices.

The Rise of China

The ancient Silk Road produced texts from Europe and the Middle East that documented therapies originating in East Asia. Islamic scholars such as Avicenna and Ibn al-Baitar compiled vast encyclopedias of botanical compounds and herbal formulas dating back to China's Han Dynasty.

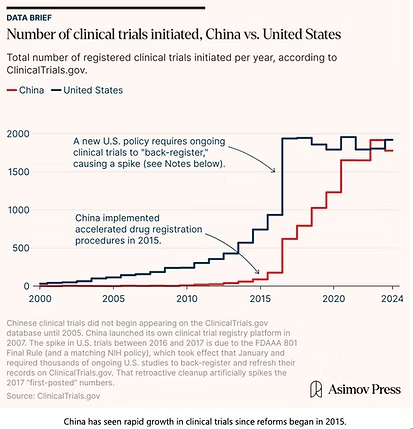

In the past decade, the rapid ascent of China in drug discovery, medical device production and clinical trial expertise has created a new era of east-west exchange. Previously, China was primarily regarded as a source for raw materials, active pharmaceutical ingredients (APIs) and generics. A dozen years ago, the United States, Europe and Japan still dominated clinical research activity with Chinese-originated companies accounting for only three percent of trials in 2013.

Chinese firms now account for 28% of clinical trials, second only to the United States and far exceeding Europe and other Asian countries. China has surpassed Europe in drug discovery, doubling its investigational drug pipeline since 2020.

Earlier this year, Chinese AI model Deep Seek shocked the world by outperforming US counterparts for a fraction of the cost. The biopharma world has also experienced several “Deep Seek” moments, where Chinese therapies outperform better-funded Western equivalents in head-to-head trials. One example is the drug ivonescimab. This bispecific antibody was initially engineered by the Chinese biopharmaceutical company Akeso. It was then licensed by the US-based Summit Therapeutics for a trial where it outperformed Merck’s blockbuster drug Keytruda for lung cancer treatment.

A presence in China is increasingly important for proximity to new ideas. The number of innovative drugs in the pipeline from Chinese manufacturers has doubled in the past four years. Chinese life science incubation hubs like Shanghai’s Zhangjiang High-Tech Park have become essential destinations for global pharma and device companies like Lilly, AstraZeneca, GSK and Roche.

Regional Reform and Harmonization

China’s rapid ascent was boosted by a series of regulatory changes in 2015 that specifically aimed to accelerate investigation and approval timelines. The number of government drug application reviewers expanded from 70 to more than 800. Additional process changes shortened approval times by more than 50 percent. In 2017, China’s National Medical Products Administration (NMPA) adopted the ICH (International Council for Harmonization of Technical Requirements for Pharmaceuticals for Human Use) shared by the US and EU. Chinese agencies also created specific incentives for multi-country trials to proceed in China in parallel with the US, EU and other markets. These changes were followed by an exponential increase in investment in the Chinese biotech sector.

In the fields of devices and diagnostics, China’s strength is concentrated in its capability for manufacturing and raw materials. It has not yet seen the same caliber of breakthrough success in novel technologies as in biopharma. Last year, however, the government prioritized a series of reforms to cut device approval timelines, introducing EU MDR-like frameworks and creating fast-track processes for high-tech devices such as surgical robotics. This appears to be a concerted effort to replicate the dynamics that catalyzed biopharma innovation during the last decade.

China is not the only Asian country focused on industry policy and regulatory reform to grow their domestic life sciences industry. Japan, South Korea, India and Singapore all have some version of a playbook to streamline agency approvals, adopt global standards and attract multinational sponsorship for clinical research.

In 2018, around the same time as China's reforms, Japan’s Clinical Trials Act created an accelerated IRB and application review processes to become one of the fastest countries in the world for clinical trial approval. India has seen exponential growth in active trials after a series of moves to facilitate submission guidance, increase regulatory staff and adopt GCP standards. Overall, the Asia Pacific region is now home to 30% of multinational clinical trials and expected to see the most growth of any region in the coming decade.

A Strategy for the New Global Era

Increased international integration is hardly inevitable. We live in an era when news headlines are filled with geopolitical tensions, trade disputes and concerns around the national security implications of vital industries.Legislation in the US such as the BIOSECURE Act, aiming to restrict the use of biotechnology equipment and services from foreign countries, would have significant consequences for multi-national firms involved in clinical research.

Despite these headwinds, the underlying fundamentals create powerful incentives for a new global era of clinical discovery bridging. These drivers include: the billions of potential patients for new drugs and devices; the benefits of connecting ideas from geographically diverse centers of excellence; and powerful AI and digital collaboration tools that make it easier to run global clinical trials at scale.

For clinical trial investors and entrepreneurs, it is important to have a geographic diversification strategy. This includes a plan to monitor novel technologies and market opportunities in key hubs throughout the US, Europe and Asia. It’s also essential to have an adaptive approach to mitigate regulatory risks and model out key scenarios. These include the impact of possible FDA budget cuts, the EU rollout of Clinical Trial Regulations guidelines and the potential revival of the BIOSECURE Act in Congress. Technology will be a decisive factor as well, with Artificial Intelligence/Machine Learning platforms for recruitment, trial design, digital twins and decentralized trial management expected to evolve at a rapid pace. Innovative startups like QuantHealth, Unlearn.ai, Deep6 and Medable will continue to have an outsized influence.

The Silk Road of the ancient world was a place of fear and wonder, uncertainty and discovery. Out of these contradictions, new fields of knowledge emerged to change the world and improve the human condition in ways once unimaginable. We are optimistic that the benefits of international exchange and collaborative innovation will prevail, enabling the promise that clinical trials can propel us into a new golden age of medicine with unprecedented progress and prosperity.

This transformation raises important questions for every stakeholder in the industry: How can your organization best position itself in this new global era? What partnerships and strategies will be most critical? At The Landrich Group, these are exactly the kinds of strategic questions we help our clients answer. With expertise spanning international markets and deep experience in clinical research and regulatory affairs, we're here to help you navigate this period of unprecedented change. Let's discuss what opportunities this global shift might create for your business.